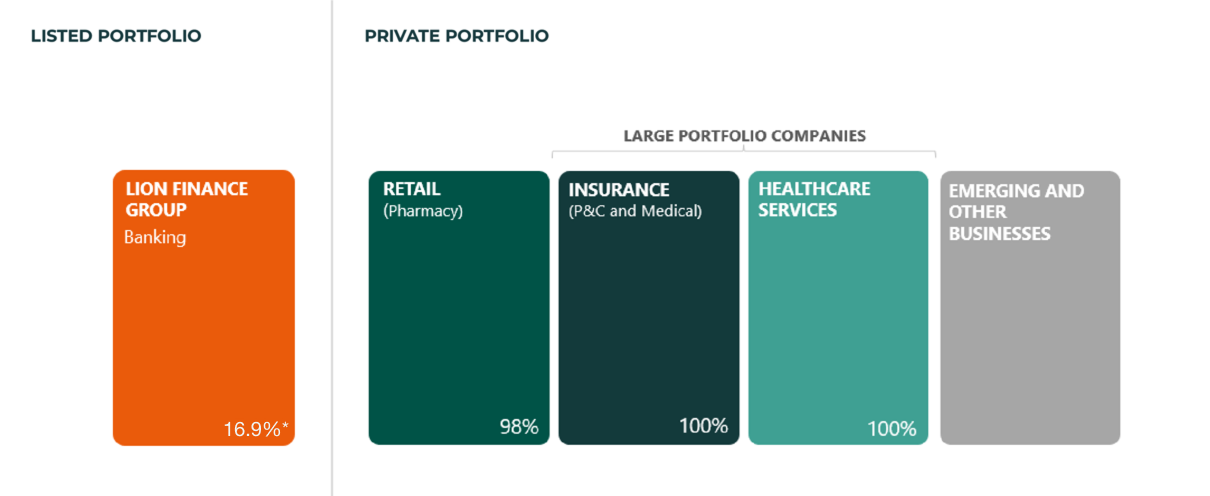

Georgia Capital ("GCAP") capitalises with its robust corporate governance on the fast-growing Georgian economy across the last decade, having access to capital and management. Georgia Capital focuses on capital-light, larger scale investment opportunities in Georgia, which have the potential to reach at least GEL 300 million equity value over the next 3-5 years and to monetise investments through exits, as investments mature.

Georgia Capital actively manages its portfolio companies to maturity, setting the strategy and business plan of each business and driving its execution. In order to unlock the value of the companies in which it invests and which it manages, Georgia Capital sets exit options prior to making an investment.